Why You Need A Debt Payoff Tracker?

Keeping track of your debt can be daunting especially when you owe multiple creditors, have many living expenses, and are super busy with your day job. A survey completed in 2019 shows 1 in 6 Canadians are spending more money than what they earn per month (see report at Canada.ca, 2020). This means 17% of Canadians today are behind on their bill payments and struggling to pay for necessities like food, shelter, and transportation.

The Debt Payoff Tracker was created to help you build a positive relationship with your money and to help you get on track. By organizing all your debt into one place, you’ll be able to see exactly how much you owe, to which creditor, the interest rate you’re paying, and how far along you are in the repayment process. Soon, debt will become a natural part of your money management skillset.

Click on the image below to get your free printable Debt Payoff Tracker.

Where did all that debt come from?

Debt, or loans, is a part of adult life for examples student loans, mortgages, credit cards, car financing, or starting a new business. You can, of course, save money to purchase those things in cash, however it may be more advantageous to leverage the bank’s money instead. So treat this as a strategy to get where you want to be.

How to Use the Debt Payoff Tracker

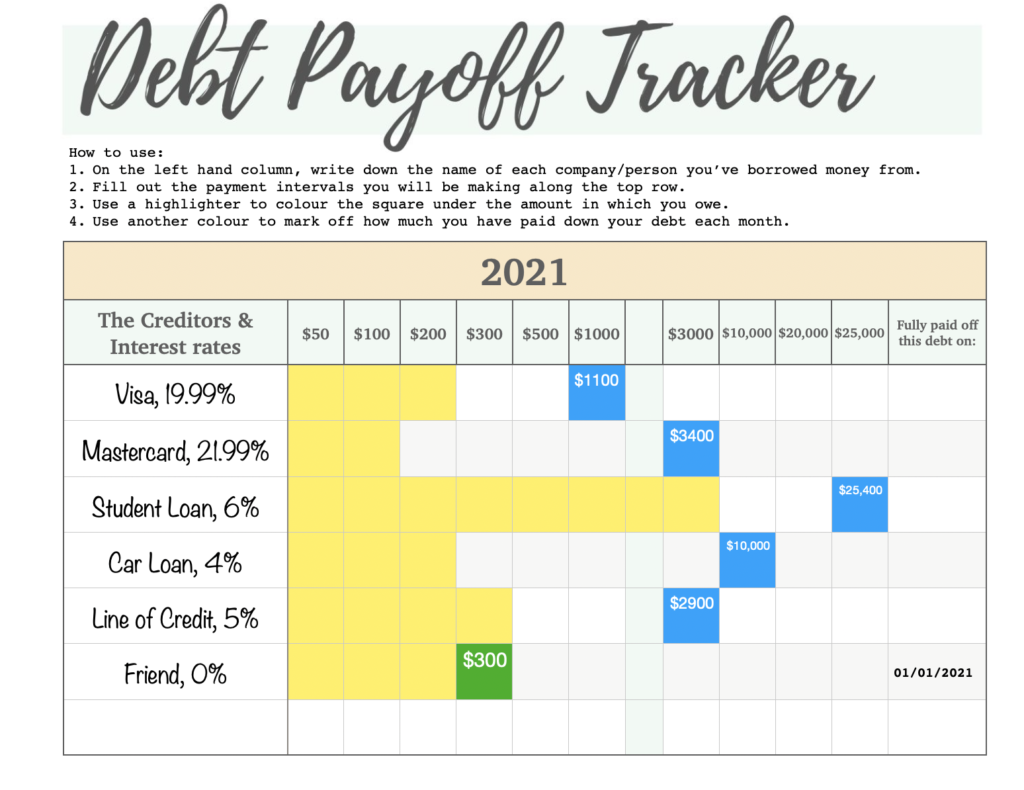

So with all the debt you have, here is how you can organize yourself using the Debt Payoff Tracker. See the example below to help you start your debt-free journey.

Ms. Millennial is a new graduate majoring in interior design. She has a part-time job and is currently working on building an interior design business through her YouTube channel. During her 4 years studying in university, she had managed to accumulate a debt totaling $43,000 from student loans, living on campus, car loans, buying equipment for her YouTube channel and other living expenses. Using the debt payoff tracker, we can see exactly how much money she owes to which creditor.

**Tip: Pay the minimum amount required for all your debt. Use any extra money you have to quickly pay off your smallest debt first. When that debt is paid off move on to the next smallest debt, and so on.**

The total amount owing is coloured in blue. The yellow highlighted boxes represent how much money Ms. Millennial has paid down towards her debt. The two creditors, MasterCard and the Line of Credit are similar in the amount owing so both amounts are is listed under the $3000 column.

As you can see, Ms. Millenial was able to pay her friend in full on Jan. 1, 2021. As each month passes, we can see progress being made as more yellow boxes are filled in.

This Debt Payoff Tracker is straightforward and super simple to use. Click the image below and get a free copy of this worksheet to start tracking your debt today.

How much money should I put towards my debt?

The more money you can put down towards the debt the faster you will be able to eliminate it. Treat your debt as if you were paying electricity bills. Start with paying just the minimum from each lender then put any extra cash towards your smallest debt until that’s paid off and then move on to the next smallest debt, and so on.

And that’s it!

Paying off debt is really that simple, once have a plan and get organized. Your debt will be paid off in no time.

– The Wealthy Sheep

Leave a Reply